-

Taxes

TaxesUnderstand Tax Implications and Responsibilities with Cash App

Jan 28, 2024Navigate all the complexities of tax implications through this cash app tax review to make informed financial decisions.

-

Taxes

TaxesHow Trading-In Your Vehicle Affects Sales Tax: A Detailed Look

Jan 31, 2024A trade-in can reduce sales tax in some regions as tax is often applied to the price difference between the new item and the trade-in value. Click to learn more.

-

Taxes

TaxesA Comprehensive Guide to Understanding Section 250 of the Income Tax Act

Jan 20, 2024Explore the intricacies of Section 250 and GILTI, its impact on shareholders' tax obligations, and strategic measures to optimize compliance and minimize tax exposure.

-

Taxes

TaxesWhen Will The New Tax Rates Take Effect in 2023, Exactly

Jan 12, 2023In the face of rising prices, the typical American household may benefit from upcoming tax revisions. The IRS adjusted income tax bracket levels for 2023 to account for rising prices. While these adjustments are made every year according to a formula specified by Congress, the large increases this year are welcome news for anyone whose wages have not kept up with huge price increases over the last year. All filing methods now have a higher standard deduction

-

Taxes

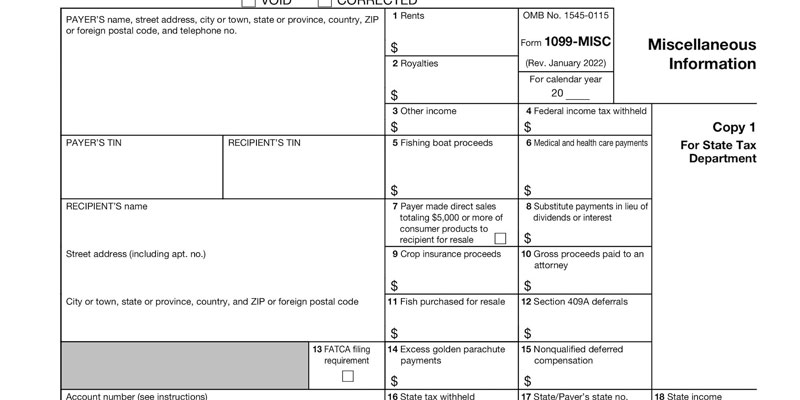

TaxesDifferent Uses Of Form 1099-MISC

Jul 28, 2022For individuals and businesses that have been paid $600, the Form 1099-MISC is used to record miscellaneous income.