-

Know-how

Know-howAn Insider's Guide to Premarket Trading: Opportunities and Considerations

Jan 27, 2024Find out all about premarket stock trading, its opportunities, considerations, and more. Read about the major advantages and drawbacks that you must know about premarket trading.

-

Know-how

Know-howBreaking Down Cost of Goods Sold (COGS): A Step-by-Step Calculation Guide

Jan 27, 2024The Cost of Good Sold is a crucial financial measure. Discover its definition, formula, calculation, and profitability impact. Critical for corporate success and strategy.

-

Know-how

Know-howTop Medicare Part D Prescription Plans in 2024: An Expert Review

Jan 27, 2024The finest prescription benefits need careful selection. Consider factors like costs, features, and member experience to understand Medicare Part D prescription plans. Read top Medicare Part D plans 2024.

-

Know-how

Know-howA Step-by-step Guide to Filing Your LLC Articles of Organization

Jan 27, 2024This comprehensive guide outlines the crucial steps for forming an LLC, covering aspects such as choosing a business name, identifying a registered agent, and obtaining necessary permits.

-

Know-how

Know-howUnderstanding the DUNS Number: A Comprehensive Guide

Jan 22, 2024This comprehensive guide explores the importance of DUNS numbers for businesses, outlines the application process, and debunks common misconceptions. Improve your creditworthiness and unlock growth opportunities.

-

Know-how

Know-howWhat to Know About Revenue-Based Financing, Its Benefits, and How It Works

Jan 27, 2024If you're searching for insights on Revenue-Based Financing, our guide simplifies it all. Learn the benefits and how it works in straightforward terms. Explore now!

-

Know-how

Know-howNavigating the Financial Aid Maze: Unpacking FAFSA Simplification

Jan 25, 2024Discover the profound impact of FAFSA simplification on your financial aid experience. Explore how recent changes can make navigating financial aid easier than ever before.

-

Know-how

Know-howDecoding the Russell 2000 Index and its Impact on Small-Cap Stocks

Jan 25, 2024Explore the world of small-cap stocks through the lens of the Russell 2000 Index. How this index works, why it matters, and the exciting opportunities for investors.

-

Know-how

Know-howThe Unveiling of Equity Injection: A Simplified Guide to Business Funding

Jan 22, 2024Unlock growth with equity injection—a financial boost for your business. Learn its importance and role in securing investments for business growth.

-

Know-how

Know-howPlanning for Home Maintenance: Tips, Tricks and Timelines

Jan 21, 2024Planning for Home Maintenance: Tips, Tricks and Timelines provides a comprehensive guide to efficient and effective home maintenance. Covering everything from making a plan, staying consistent, delegating tasks, and sourcing professional help, the guide offers practical advice to take the stress out of home upkeep.

-

Know-how

Know-howMaximizing Savings: A Closer Look at Mileage Tax Deduction Rules

Jan 18, 2024Explore the basics of mileage tax deductions, record-keeping requirements, and how to calculate your deductions. Understand the IRS rules for better tax savings.

-

Know-how

Know-howComplete Understanding of Joint Endorsement and Its Operational Mechanism

Jan 03, 2024Joint endorsements are essential in shared finances. Click here to learn their operational mechanism, challenges, benefits, and disadvantages.

-

Know-how

Know-howAPY vs Interest Rate

Jul 29, 2023Find out how understanding the differences between an APY and an interest rate can help you make smarter decisions about saving money or investing. Learn how to compare financial products for better returns on your hard-earned cash with this guide.

-

Know-how

Know-howWhat Do You Know About Self-Directed 401(k)

Jun 04, 2023With a Self-Directed 401(k), participants can choose where their retirement funds are invested. A Self-Directed 401(k) gives account holders more freedom to invest in various assets, including real estate, private equity, and precious metals, than regular 401(k) plans. Because of this adaptability, retirees can make their investment portfolios as conservative or aggressive as they like.

-

Know-how

Know-howDivorce: How To Divide The House

Mar 07, 2023Buying a property jointly as a married couple is usually both partners' biggest investment. The division of the marital residence is, thus, a major issue for divorcing couples. How much the home has appreciated depends on several factors, including the state of the market and the number of years the current owner has lived there

-

Know-how

Know-howEfficient Methods to Limit Holiday Expenditures

Feb 21, 2023If you want this Holiday season to be more pleasant and less stressful, try cutting back on your expenditures. Learn how to rein down your spending before it gets out of hand.

-

Know-how

Know-howCheapest Car Insurance

Jan 08, 2023It is in the best interest of Oklahoma drivers who are concerned about paying too much for their car insurance to conduct some comparison shopping. Even if you are a safe driver, you can cut your annual car insurance costs by shopping about and comparing different providers by several hundred dollars.

-

Know-how

Know-howHome Inspection Report

Sep 27, 2022Inspecting your home can save you from potential costly surprises, such as defects in the structure or hidden damages. Although it is not legally required, buyers, particularly first-time home buyers, will significantly benefit from having an expert perform an extensive inspection before settling the purchase.

-

Know-how

Know-howEverything About the Best High-Risk Car Insurance

Aug 24, 2022The driving record and the customer's demographic profile are two factors that insurers consider when determining a policyholder's premium. Those considered to be a more significant financial risk are charged more. A driver's risk level can be assessed by looking at their driving history and whether they have a traffic violation pattern or accidents.

-

Know-how

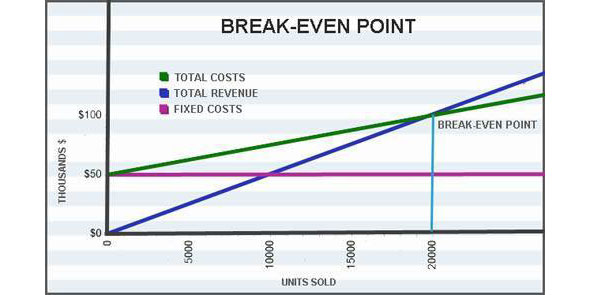

Know-howAll about Break Even price

Aug 03, 2022Break-even valuation is a pricing technique used in accounting that finds the cost at which a commodity will make no profit. If you look at the cost as a percentage of revenue, this is known as the point of equilibrium