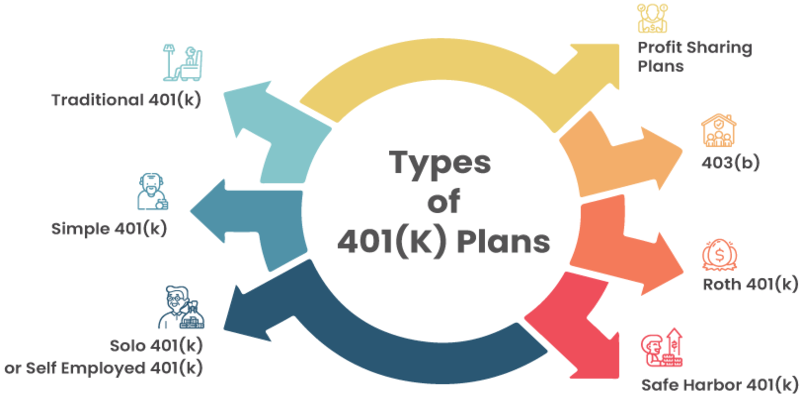

What is a Self-Directed 401(k)? Individuals can take charge of their retirement savings by opening a Self-Directed 401(k) and investing the money any way they see fit. Investment options in a Self-Directed 401(k) are broader than in traditional employer-sponsored 401(k) plans, which often restrict participants to several mutual funds or company-approved investments. Individuals can diversify their retirement savings with a Self-Directed 401(k) by purchasing stocks, bonds, real estate, precious metals, cryptocurrencies, and other assets. Individuals can take advantage of their knowledge, expertise, and investment choices to shape their financial futures using this form of retirement plan. Individuals can diversify their portfolios beyond standard assets with the help of a Self-Directed 401(k), expanding their opportunities for development and return. But remember that with great power comes great responsibility.

Knowing How To Use A Self-Directed 401(k)

This portion of the article is an introduction to the Self-Directed 401(k) and a summary of its main benefits. This article compares and contrasts the investment options and eligibility requirements of a Self-Directed 401(k) with those of a regular 401(k) plan. It also discusses how to open a Self-Directed 401(k) account, what kinds of investments are allowed, and how much say account holders have in those decisions.

Benefits of a 401(k) That You Manage Yourself

The advantages of a 401(k) for self-management are discussed below. This sort of retirement account is highlighted because of the freedom it provides its holders to invest in a wide variety of non-traditional assets. It also highlights the possibility of customizing investments to suit one's knowledge, interests, and ethics. It also covers the historical performance of various asset classes and the case of increased returns via alternative investment strategies.

Concerns and Possible Dangers

This article's next section digs into the pros and downsides of a Self-Directed 401(k) and the hazards that you should be aware of. It stresses the importance of investigating opportunities, identifying risks, and comprehending legal and regulatory ramifications before making investment decisions. This section also discusses the dangers and difficulties that individuals should be aware of when managing a Self-Directed 401(k), as well as the tax ramifications and compliance requirements that must be met.

How to Start Your Own 401(k) Plan

In this piece, we'll walk you through opening a Self-Directed 401(k) account. It stresses the need for a trustworthy administrator or custodian and specifies their duties. Instructions for opening an account are provided, covering required documentation, moving existing retirement savings, and establishing an investing strategy.

Exemplified Achievements and Useful Lessons

The essay concludes with a collection of case studies and success stories involving investments made with a Self-Directed 401(k). Particular scenarios are examined, such as profitable real estate investments made using a Self-Directed 401(k), to illustrate the advantages and takeaways of this strategy. This section may also include a discussion of alternative assets like private equity and startups to highlight the flexibility of a Self-Directed 401(k) plan.

Compliance and Regulations

This article's next section looks more deeply into the compliance standards and regulatory framework that govern Self-Directed 401(k) programs. The Employee Retirement Income Security Act (ERISA) and the Internal Revenue Service (IRS) discussed their roles as regulators of such retirement funds. The need to avoid conflicts of interest and know the consequences of working with disqualified individuals is emphasized. The importance of seeking expert counsel and direction for conformity with all regulations is also stressed in this section.

Choosing an Investment Strategy

In this piece, we'll explore the numerous investment opportunities accessible to those with a Self-Directed 401(k) plan. It delves into various investments, including properties, commodities, digital currencies, private companies, etc. It covers the pros and cons of each investment category, as well as criteria to determine whether they are appropriate for a Self-Directed 401(k) plan. This part also includes advice on how to do your homework, analyze the market, and diversify your portfolio.

Case Studies and Learned Lessons

Here we look at further real-world instances of people who have used Self-Directed 401(k) plans to enhance their retirement savings, including case studies and success stories. It looks at several investment approaches, from real estate to alternatives, highlighting the results and takeaways from each. This part aims to motivate and instruct readers by giving them real-world examples and suggestions they can put into practice right now.

Conclusion

The paper concludes by summarizing its primary arguments and reiterating the idea of a Self-Directed 401(k) as an effective tool for those who want more say over their retirement savings. It stresses the value of doing homework, consulting with experts, and being aware of the potential pitfalls and legal constraints of administering a Self-Directed 401(k). The final section suggests that people look into this type of retirement savings to personalize their investment portfolio, achieve their financial goals, and improve their long-term financial stability.